The Tax report is a summary of your food program income and estimated expense for the calendar year. Use this report as an aid for income tax preparation.

Note: This report is similar to the Standard Meal Allowance report, which is available to KidKare Accounting users. The Tax Report is available for all providers on the food program.

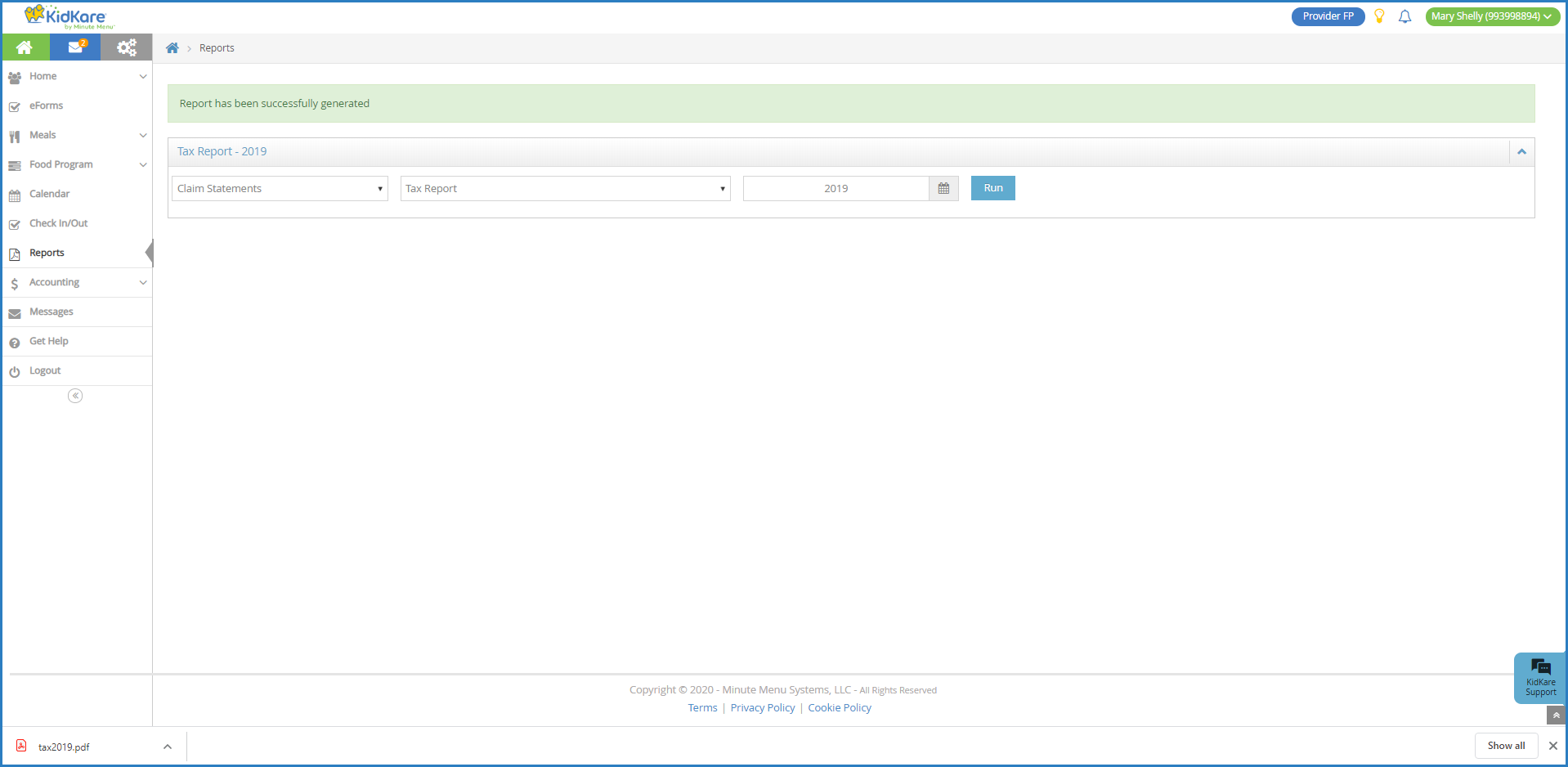

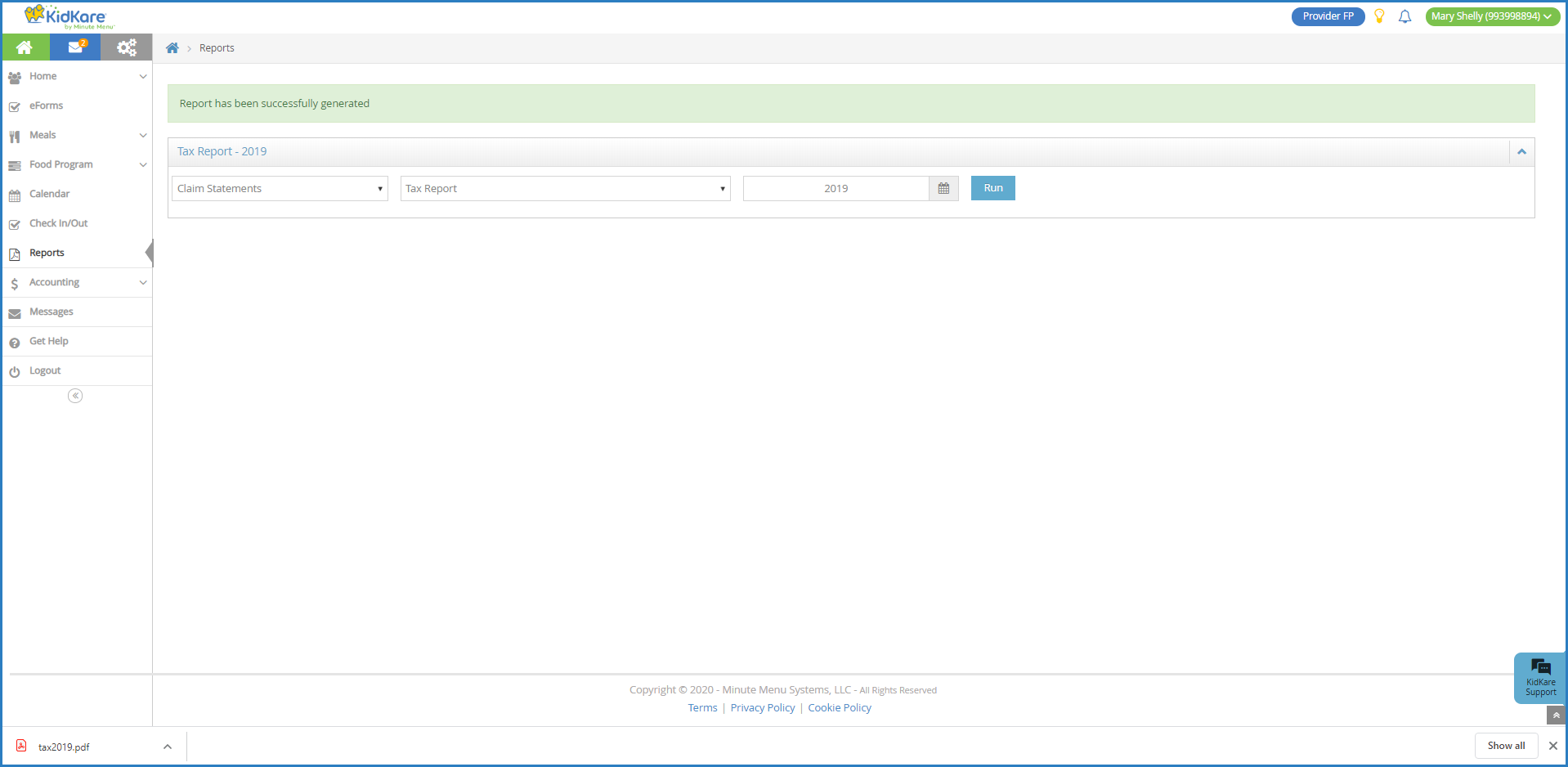

To print this report:

- From the menu to the left, click Reports. The Reports page opens.

- Click the Select a Category drop-down menu and select Claim Statements.

- Click the Select a Report drop-down menu and select Tax Report.

- Click the Select Year box and select the year for which to print the report.

- Click Run. A PDF downloads.

How to Read the Tax Report

The Tax report includes the following sections:

- Taxable Income

- Deductible Food Expense

- Monthly Payment History

We'll discuss each section in detail, below.

Taxable Income

The Taxable Income section gives a total dollar amount paid to you for the tax year.

- Total of All Payments Received: This is the total dollar amount of all payments your sponsor made to you for claims reimbursement.

- Non-Claim Payment Adjustments: These are payment adjustments made by your sponsor. These amounts are not included in the Total Taxable Income amount.

- Own Child Reimbursement: This is the amount of reimbursement made to your own children. This amount is also not included in the Total Taxable Income Amount.

Deductible Food Expense

The IRS has developed a standard food deduction for individuals operating a childcare business. This standard deduction is based on Tier 1 rates in effect at the beginning of the calendar year (January 1 - December 31). It includes all meals served, including those that were disallowed on a claim.

Based on information submitted on your KidKare claims, the Deductible Food Expenses section provides our estimate of your standard tax deduction for child care food expenses. Note that if you served more meals than you recorded in KidKare, you may need to adjust this figure before recording it on your taxes.

For helpful information about navigating taxes as a child care provider, visit Tom Copeland's Taking Care of Business blog.

Notes: As meal counts are calculated when your sponsor processes your claim, reference this report only after your sponsor has processed your December claim. Meal totals in this section will typically never match the meal totals in the Taxable Income section, because you are reimbursed in the month following the claim (e.g. January meals are reimbursed in February, and so on).

Monthly Payment History

The Monthly Payment History section at the bottom of this report itemizes all payments made in the calendar year.