You can enter household income information directly into KidKare. KidKare will then calculate the child's reimbursement level and FRP basis.

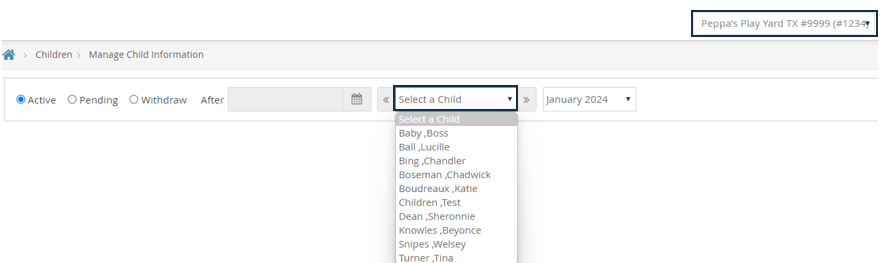

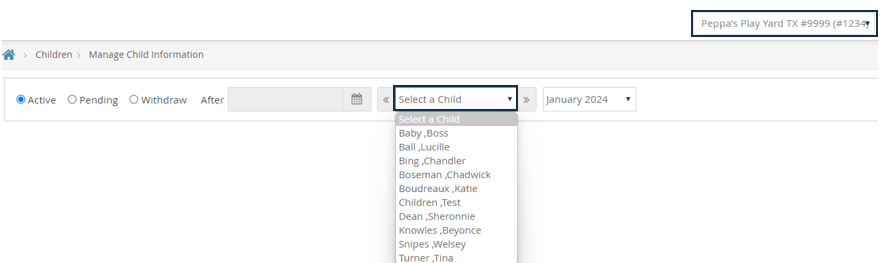

- From the menu to the left, click Children.

- Select Manage Child Information.

- Select the Center and Child that needs to be updated from the drop down.

- The Manage Child Information window opens.

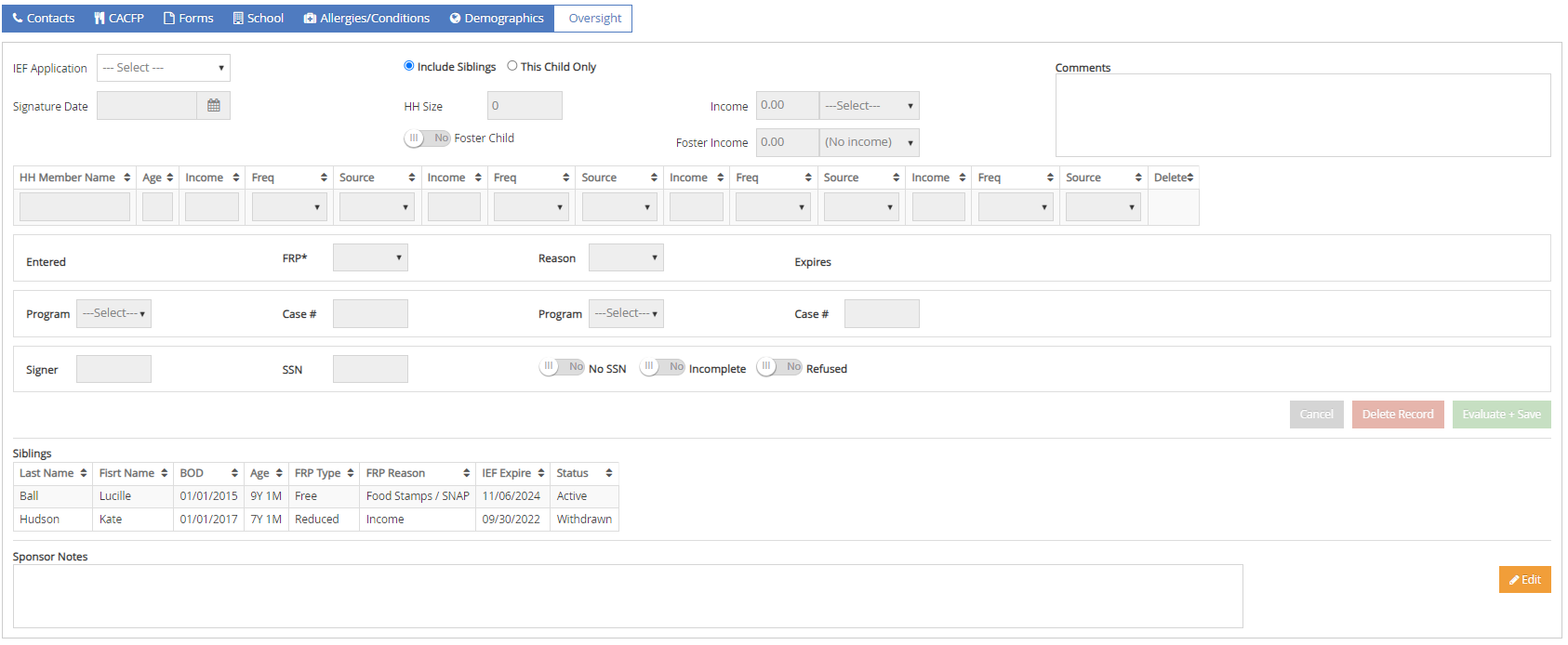

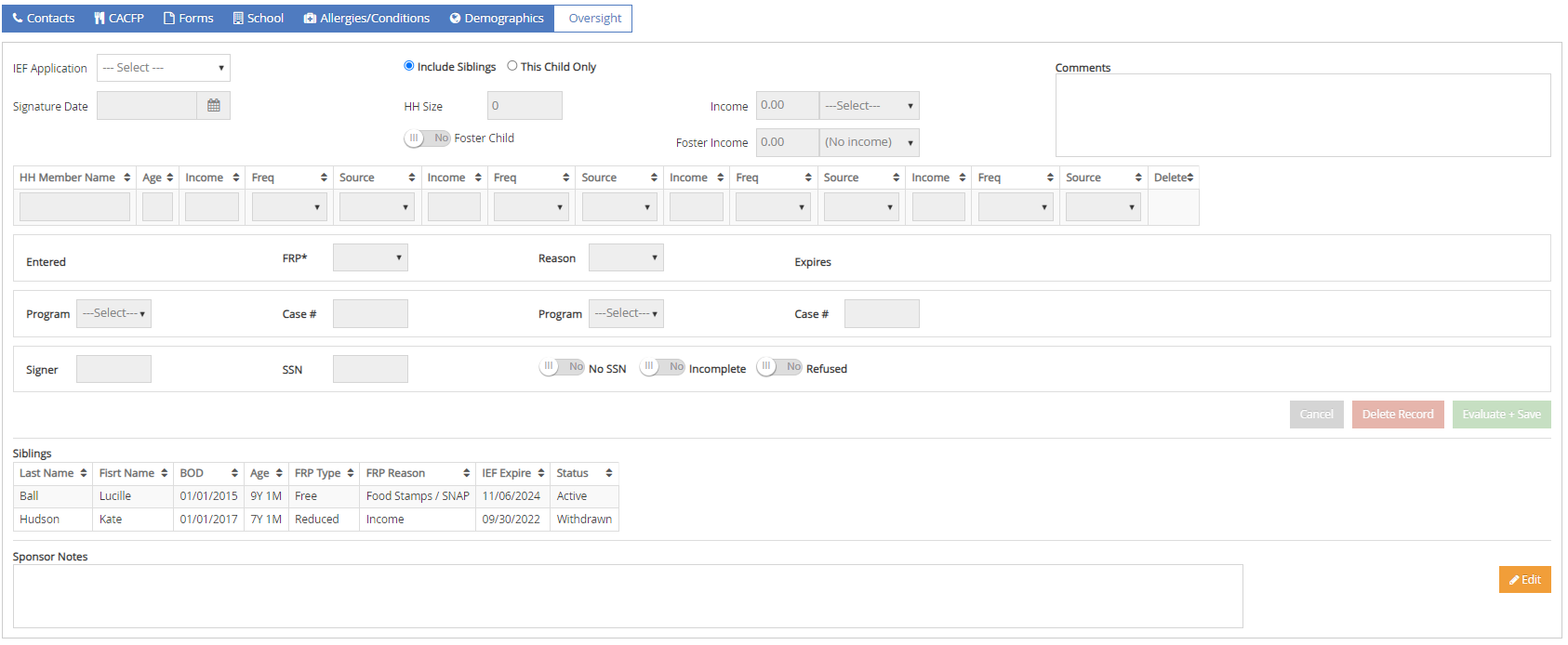

- Click the Oversight tab. The income eligibility calculator is in the bottom half of the tab.

- Click Edit in the bottom right corner.

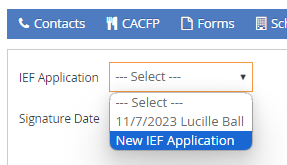

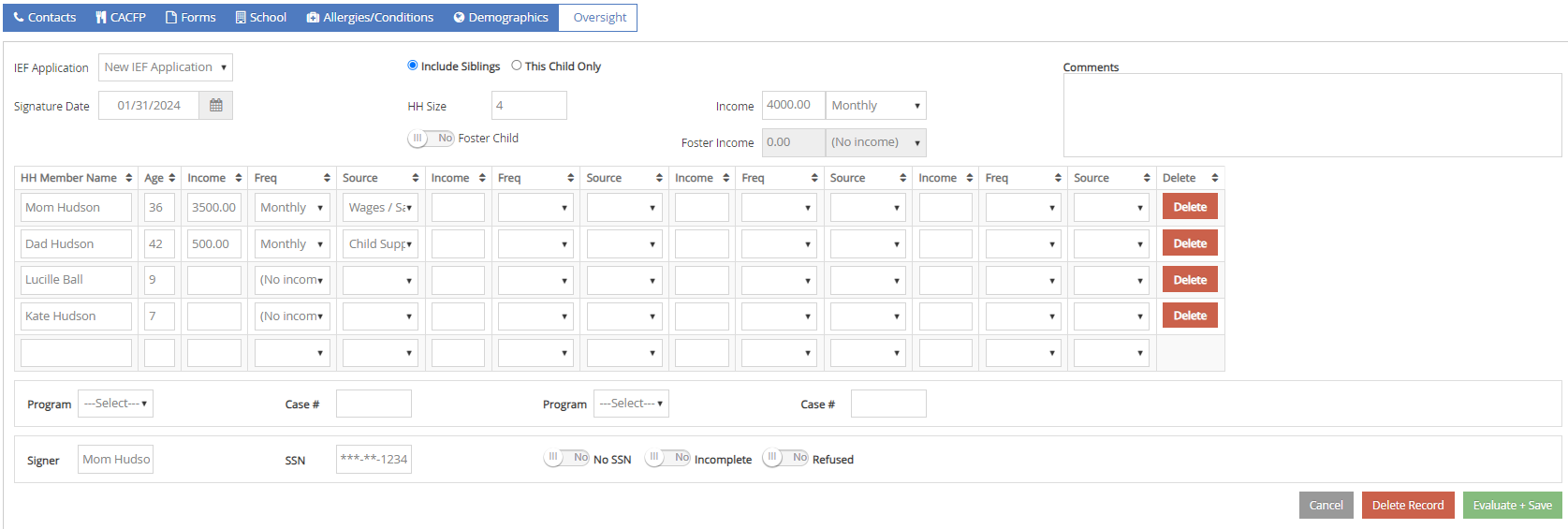

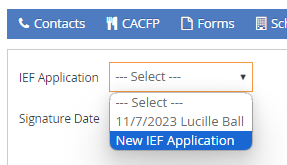

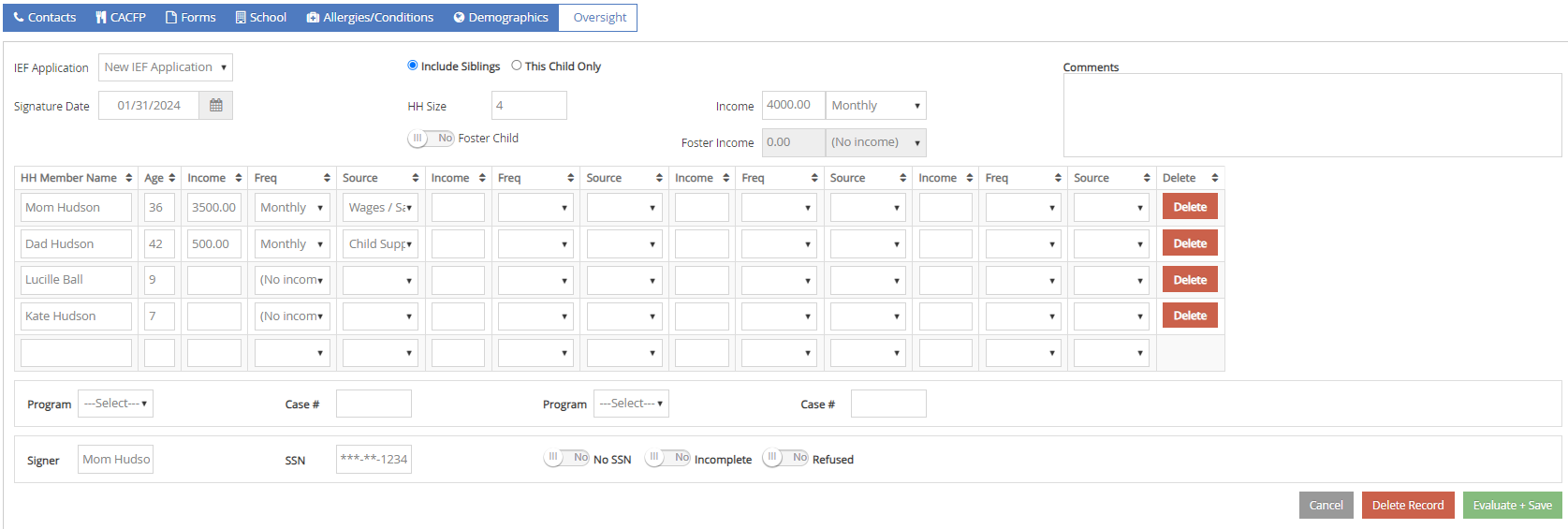

- In the IEF Application drop down, select New IEF Application.

- Click the Signature Date box and select the date the parent signed the form.

- To enter household income fill in the required fields below:

- Select if you are Including Siblings or entering for This Child Only.

- Click the HH Member Name box in the table and enter each household member's name. You must enter all household members, including children. As you add names, the value in the HH Size box increases.

- Click the Age box for each house hold member and enter their ages.

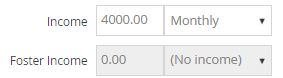

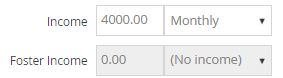

- Click the Income box for each household member with an income and enter their income amount. The Income box will automatically

- Click the Freq drop-down menu and select the income frequency. For example, if you entered yearly income, you would select Yearly.

- Click the Source drop-down menu and select the income source. For example, if these are wages, you would select Wages/Salaries.

- If there are multiple income sources for one person, scroll to the right and repeat Steps 7c -7e to add additional income.

- For each child listed, click the Freq drop-down menu and select No Income.Note: If the parent refused to provide income or program information, check the Refused box.

- To enter qualifying program information (if applicable):

- Click the Program drop-down menu and select the program.

- Click the Case # box and enter the provided case number.

- Repeat Steps 1 & 2 to add an additional program.

- If this is a foster child, check the Foster box.

- Click the Signer box and enter the name of the person who signed the form.

- Click the SSN box and enter the signer's social security number. You must enter all nine digits. If no SSN was provided, check the No SSN box.

- Once all IEF form information has been entered, Click Evaluate + Save.

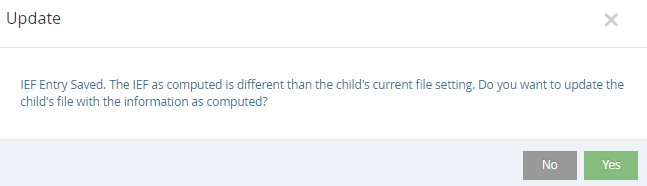

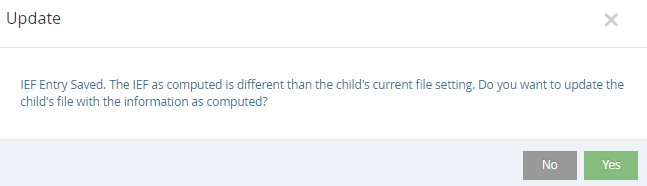

- Click Yes in the pop-up to update the information if the IEF computed is different than the last time it was entered.